Kora is a popular musical instrument in the

Western/Eastern region of Africa frequently played in songs of celebration, or

to pass a message of hope. Kora is also a project of hope for billions of

people who are underserved by the current financial system.

While there has been progress toward financial

inclusion, an estimated 2 billion adults worldwide don’t have a basic account. Barriers

to account-opening include distance from a financial service provider, lack of

necessary documentation papers, and lack of trust in financial service

providers.

See this video for more details about Kora Network

KORA Bounty Program

Problems

High Cost to Serve

Opening bank branches in rural or remote areas is

unprofitable due to high costs such as property fees, staff headcount, and IT

infrastructure. To offset these costs, banks charge high fees for account

maintenance, ATM withdrawals and money transfers Physical travel is another

issue; it can sometimes take more than a day to reach bank branches or ATMs.

Misconception that the Underserved have Little Value

The general perception is that underserved customers

would be transacting in “small” amounts. However, PWC estimates that the global

unbanked population holds at least $360 billion in unmet deposits in 2016

alone. In addition, a 2016 McKinsey report estimates that widespread adoption

of financial services through digital finance could result in a $3.2 trillion

increase in GDP of all economies by 2025.

Lack of Identification Documents

According to the World Bank, 1.5 billion people

worldwide lack any form of valid identification. Official or valid ID for

opening a bank account is often difficult to obtain in developing countries.

Lack of Trust and Technological Understanding

Many people without bank accounts perceive banks as

unsafe. There still exists a widespread lack of trust in financial technology,

including ATM’s and online banking.

Lack of Financial Literacy

We believe that with limited financial literacy,

people may be at risk of making poor financial decisions including taking loans

with interest rates they may not be able to pay, getting involved in pyramid

schemes, or paying unreasonably high charges on remittances or foreign exchange

mark-ups.

The Kora Ecosystem

We believe Kora will build wealth by creating

self-sustaining, community-owned ecosystems. “Selfsustaining” means the wealth

in the community as a whole grows, and “community-owned” means participants in

the existing community take on most of the key roles within the ecosystem.

eFiat

eFiat are digital versions of national currencies

that are 100% backed by cash reserves, and redeemable on a 1:1 basis. eFiat

will increase ease of use and adoption by offering users the benefits of

digital currency in a form they understand and trust.

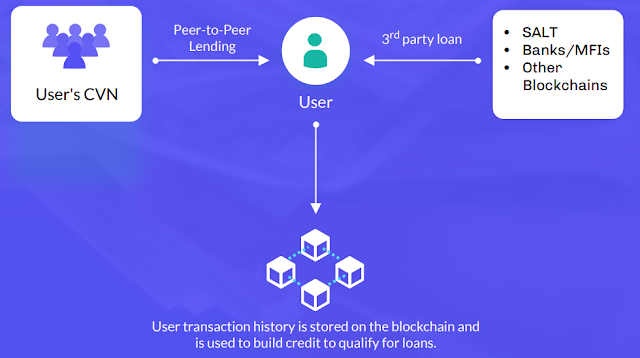

Community Value Networks

Kora aims to empower instead of displacing existing

communities. Communities already providing ad hoc financial services will join

the Kora Network as Community Value Networks (CVNs).

Driving Adoption

Universal Access

Feature phones and SMS are still the dominant means

of communication in developing nations, and Kora can be utilized with even the

cheapest feature phones, or users can input a short code-number via USSD. Kora

will also provide a smartphone and web-based application. The user’s

transaction history will be stored on the blockchain and will be accessible if

the user later upgrades to a smartphone.

Identity

An estimated 1.1 billion people worldwide cannot

officially prove their identityxvii. Proof of identity is a significant barrier

to accessing financial services. Kora will provide a flexible on-boarding

process that will allow users to join the Kora Network xix in compliance with

all applicable laws and regulations. Upon joining, users will build reputation

scores connected to their actions within the Kora Network, as well as the

actions of the users they are connected to and transact with within the Kora

Network. The user’s transaction limits and access to services will increase as

they add more documentation and prove themselves to be honest and credible

actors. The actual proof of “identity” of users draws on the model pioneered by

uPort, with a focus on both privacy and recoverability.

Low Cost

The Kora Network aims to simplify operations so that

new Providers can provide financial services to Users without the cost of establishing

and running a front-toback financial institution. Kora will make launching a

financial services business as inexpensive and easy as launching a new instance

on AWS -- at low cost and with access to all functionality on the Kora Network.

Core software will be run on the decentralized stack, and anyone can customize

this software. Members will be able to link and exchange financial services to

other users on the Kora Network with low costs and near-instantaneous

transaction speeds. We expact the balance of power to shift, and financial

service providers would have to compete for customers, driving down prices for

users.

Network Architecture

The Kora Network will be built on Ethermint, We

chose Ethermint because it supports the Ethereum development community, which

is the largest in the blockchain space, while also supporting high volumes of

transactions and providing flexibility for more extensive user privacy.

Producers

will compete to be selected by publishing their hardware and network

specifications, displaying their digital identity and making the Kora Network

compliant with all applicable laws and regulations.

Kora Network Token (KNT)

KNTThe native Kora Network token will be referred to

as “Kora Network Token” or “KNT” and will be used as the staking unit for

selecting block producers, as well as a single medium to pay for costs incurred

by the Kora Network. Holding KNT equates to having a partial role in the Kora

Network.

When users transact on the Kora Network, they will

pay a fee denominated in KNT and set by the validating Block Producer. The

Block Producer shares this fee with the holders who voted for them. High

transaction fees, which only benefit the block producers and stakers who voted

for them, will prevent users from transacting on the Kora Network. The less

transactions that occur on the blockchain, the less rewards all block producers

and stakers will receive. Thus, KNT holders are incentivized to vote in block

producers who keep transaction fees low.

Use Cases

Money Transfer & Payments

Today, if someone living in London wants to send

money back to their mother in a village in Nigeria, they have to go to a local

money transfer company (i.e., Western Union, MoneyGram, TransferWise, etc.),

which normally takes about 5-8%+ fees. Then, their mother has to go or send

someone to travel two, three hours to the nearest place to pick up the cash.

With Kora, users will also be able to pay for mobile airtime and data

subscriptions, bills, merchants and third-party services for energy, education,

micro insurance and other use cases.

Lending & Loaning

Today, if a citizen of Botswana wants to take out a

loan from a local bank or other lender to start business, they need to, among

other things, provide multiple forms of ID that is acceptable to such lender,

meet the educational standards set by such lender, provide previous statements

of accounts for a minimum of one year, provide valid business registrations

from a centralized operator and provide signed referrals from parties who have

sufficient and verified balances with such lender.

Agriculture

Across Africa, agricultural activities are conducted

in rural areas, which are characterized by a high density of unbanked people.

Large corporations receive their agricultural supply and raw materials from local

farmers, but the farmers are not paid until after three to four weeks of

supplying due to the widespread lack of financial identities or bank accounts.

Most transactions are cash-based through every step in the supply chain,

facilitating the use of middleman and corruption which result in farmers not

being able to receive full payment.

International Distribution of Funds

One of the greatest challenges of international aid

is corruption. Multiple channels are needed for aid to get to its intended

target, but at each channel, a large portion of money is unaccounted for. Kora

solves this by distributing and tracking funds on the blockchain, so

communities receive the full help they need. For humanitarian missions, every

user in the country affected can be given a humanitarian Kora account, which

will enable the user to receive transactions with vouchers that allow them to

access multiple services through SMS/USSD or the mobile app.

Kora Roadmap

Kora’s short-term vision is to bring robust financial services to

everyone by 2021.

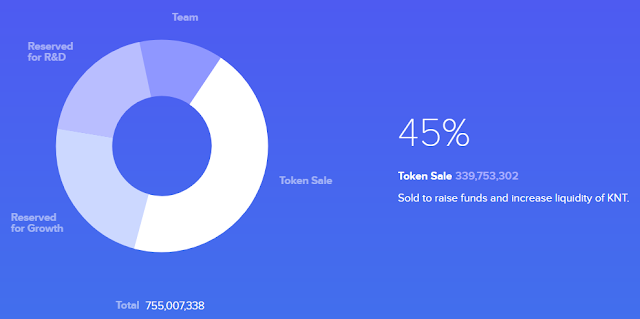

Token Sale Details

The launch of the Kora Network, and the token

creation and emission process, will be organized around the Kora Network public

blockchain. The goal of our token sale (the Token Sale) is to decentralize

ownership of KNT to ensure the crypto-economic stability of our network, and to

exchange KNT for capital to execute on our vision of unleashing the world's

potential for wealth creation and becoming a leader in financial services [for

the unbanked].

- Contributors supporting the development of the Kora Network can do so by sending Bitcoin or Ether to the designated address.

- The KNT received by a contributor is fixed at the USD price at which they bought it. The hardcap for the Token Sale is $24 million.

- Further details about the Token Sale will be released online. Sign up on our website to stay up to date, and to complete the contribution process.

- The Token Sale will be split into two phases: Pre-Sale and Public Sale.

- The minimum investment amount for the Pre-Sale is $5000.

- There is no minimum investment amount for the Public Sale, and the maximum is $1 million per unique identity. • Excess contributions will be refunded.

- Kora Technologies Limited controls the contract, and the multi-sig address to which funds will be sent.

- KNT will be distributed to Contributors as an ERC20 token after the token sale is completed. KNT-ERC20 tokens can be redeemed for KNT on the Kora Network when the public blockchain is launched in Q3 2018.

- All unsold tokens will be burnt

KNT Supply

Use of Funds

Funds raised during the Token Sale will be used

solely for the research, development, and growth of the Kora Network. The Use

of Funds will be monitored by the Board of Advisors, and we expect to use the

following structure when operating our project.

Team

Dickson Nsofor

CEO & Co-founder

Maomao Hu

COO & Co-founder

Oleh Ostroverkh

Chief Blockchain Architect

Dan Buckley

CFO

Socrates Ayvaliotis

Cryptoeconomic Design Lead

Roman Katsala

Lead Developer

Victoria Mygalko

Product Lead

Zahen Khan

Head of Marketing

Lauren Harrington

Business Analyst

Gideon O'tega

Africa Operations Lead

Bryan Uyanwune

Business Development Lead

Eugene Fine

Blockchain Advisor

Advisors

John Edge

Chairman, ID 2020

Dinis Guarda

CEO, LifeSci

Faisal Khan

Leading Banking & Payments Consultant

Nako Mbelle

CEO, Fintech Recruiters

Steven Sprague

CEO, Rivetz

Tidak ada komentar:

Posting Komentar